Best to be known Factors That Could Affect Your Health Insurance For Family

With an ongoing pandemic thrust upon us, people have started taking health insurance a lot more seriously than they used to. Top health insurance companies are introducing corona virus health insurance to help the matter. The importance of health insurance is much more than people normally realize. It is only when a health emergency happens that people feel the lack of the support that they could have received had they opted for a health insurance earlier. Therefore, it is advisable that every family opts for an affordable health insurance that would back them up during health emergencies.

Following are the best to be known and to be understood factors that can affect the health insurance of the family:

1. Pre-Existing Medical Conditions

While purchasing a health insurance, one is bound to reveal their medical history and bring up all the pre-existing medical conditions. In such cases, it is recommended that one go for a health insurance policy that covers pre-existing diseases. This will obviously lead to an increase in the cost of the insurance.

2. Medical History of the Family

The medical history of the family is essentially taken into consideration and that hugely influences one’s health. Unfortunately, genes are not something that can be controlled and thus, any history of fatal disease in the family will lead to an inevitable rise in health insurance cost. However, that should not deter anyone away from buying health cover and should rather become more of a reason to invest in it.

3. Age

Age plays a big role in determining the cost of health insurance. This happens because the older you are, the more susceptible you are to have pre-existing medical conditions and thus, increase your health cover bill.

4. Body Mass Index

People who have higher body mass index are more susceptible to have diabetes, heart diseases and such other diseases. Even simpler processes like pregnancy are treated especially if one has higher body mass index. This increases the premium rate of the health insurance.

5. Addiction

Top health insurance companies always check if the customer buying the insurance has any sort of addiction or dependency on injurious substances like tobacco, alcohol, drugs etc. Regular consumption of such items increases the chance of diseases like cancer. Hence, health insurance companies will also charge you way more if you consume the aforementioned items.

6. Profession

No matter how unfortunate it is, sometimes even your profession can determine the amount that health insurance companies will charge from you. You might have to toil a lot to get hold of an affordable health insurance for your family. This mainly happens if one works in hazardous conditions that pose a serious threat to their health.

7. Marital Status

It is widely believed that married couples live a life that is longer than others are. The insurance companies consider this factor as they form their policies depending on the statistics. Thus, if you are married, you spouse is the reason why you are paying a health insurance premium law lower than the others around you.

8. Geographical Location

Sometimes, few health insurance companies also take into consideration the geographical location that you live in. In certain geographical locations, the health insurance premium cost is way higher than that of other places. The reason behind this locational influence of the premium of health insurance owes to the fact that some places are less healthy than others owing to the prevailing climate and lack of options for healthy food.

9. Type of Plan Chosen

The type of health insurance plan chosen by an individual becomes the key determining factor about the premium that the person has to pay. It is a well-known factor that long insurance plans need way less premium that the short ones. One can search for top health insurance plans before finalizing one.

10. Duration of Policy

The period for which you choose to pay the premium of your health insurance decides the amount of money you will need to pay as your premium. It comes down to simple mathematical calculation that if you choose to pay for a longer time, you will pay smaller amount and vice-versa.

11. Gender

While deciding on the amount for the premium that the customer needs to pay, some companies that provide top health insurance plans consider the gender. They tend to charge higher for the health insurance of men because statistically men are more likely to go out for work and meet accidents.

12. City

It might sound unrelated but city that one is dwelling in plays a major role in deciding the cost of health insurance plan. If you are someone living in a metropolitan city, chances are that you need to pay higher than anyone living in a different place does. This is mainly because of the higher cost of treatment in cities.

13. Lifestyle

When deciding on the premium amount for the health insurance of someone, the insurer has to consider numerous things. Lifestyle is one of them. If your lifestyle involves engaging in high-risk activities like climbing, then your premium amount will be higher than others will.

14. Driving Record

No matter how surprising it appears to be, some companies even check driving records for deciding on a premium amount for the customer. If the individual has history of reckless driving, then their premium amount would be higher. However, in the previous five years if the individual has a good driving record, then they might get the health insurance for a lower premium amount.

15. Record of Documents

Whenever one avails the benefits of a health insurance, it is advisable that they keep a copy of all the documents- be it post-hospitalization expenses, diagnostic tests, or hospitalization records. This is essential as in some cases, the insurance company might demand to see these documents and if the individual fails to produce those, they will not be allowed to avail the benefits.

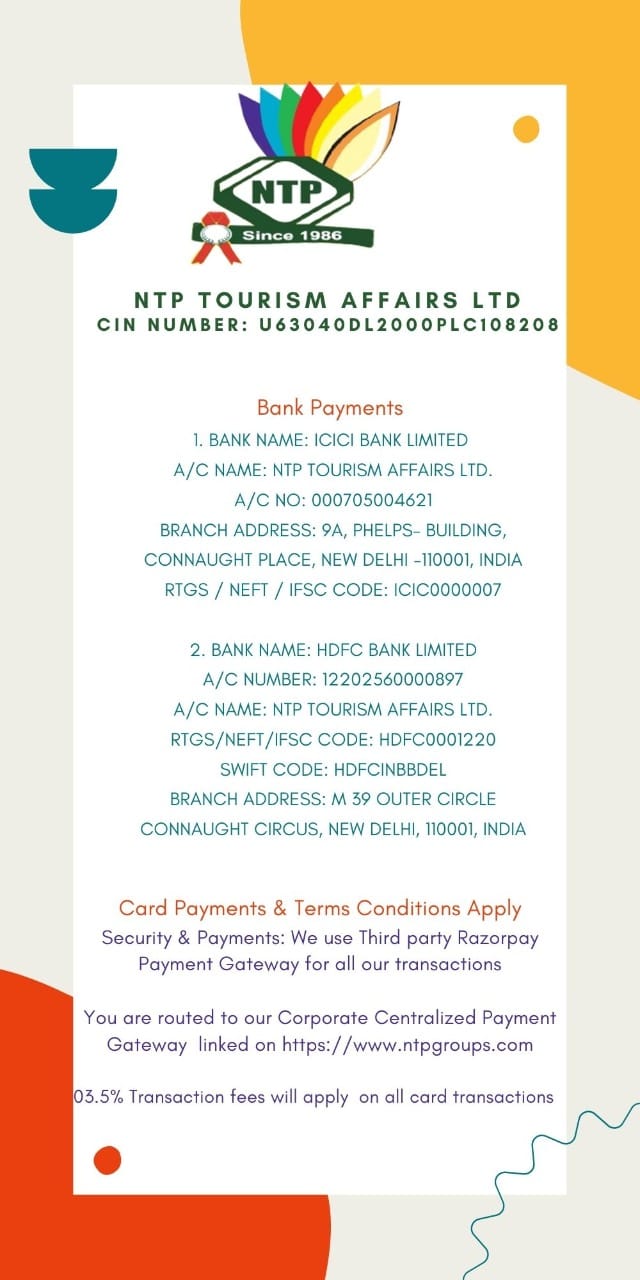

Now that you know all the essential and practical details of buying a health insurance for you and your family, it is recommended that without delay opt for one of the Medical Insurance that suit your needs and NTP Healthcare help in understanding your needs and work out the best for you.