Travel Medical Insurance coverage if traveling from India - protects you in the event of an illness or injury when traveling outside of your country of residence. It provides key medical benefits in case of an emergency.

Travel medical insurance may appear overwhelming, but its purpose is simple: travel medical insurance provides coverage for unexpected accidents or illnesses when traveling outside your home country.

Traveling abroad is an exciting experience, but unpredictable illnesses and accidents can happen. Even worse, the resulting medical bills can be overwhelming. The level of international medical coverage provided by your domestic insurance provider can vary greatly depending on your plan, so you may have very limited coverage or no coverage at all. A travel medical insurance plan can provide the coverage you need. Travel medical coverage is ideal for:

*International vacationers

*Relatives visiting from overseas

*People going on cruises, safaris, or guided tours

*International business travelers

*Students studying abroad

NTP Healthcare Services also offers travel insurance that protects your health as well as your trip costs and travel expenses. And if you need long-term medical coverage, check out our international health insurance. Insurance Plan of the Indian Medical Insurance companies plans include a wide range of medical benefits, protection, and support should a problem arise.

Prior to the coronavirus pandemic, most countries didn’t require travel medical insurance for entry, but many countries are now requiring proof of travel medical insurance (some even require COVID-19 coverage) to enter (yes, even for short trips).

Essential Things covered by your Travel Insurance

Are you planning your first international travel? Confused, about how to go about travel insurance? Well, let’s take a deep insight to understand what does travel insurance covers? NTP Healthcare offers TRAVEL INSURANCE PLANS with a wide range of cover for overseas destinations such as USA, UK, and Japan. The decision of what to look out for before buying travel insurance depends on the type and purpose of travel, whether you are traveling with family for a vacation, taking business trips for work, or student travel.

Let’s look at what does travel insurance covers? Or essentials of travel insurance

1. Medical Cover: Medical treatment costs at overseas destinations are quite high. In case you fall sick or meet with an accident, the medical expenses may shatter your financial planning. Hence, while traveling across the length and breadth of the world, it is very important to ensure your medical necessities are taken care of by the travel insurance.

2. Destinations covered: Ensure most of your destinations are covered, so that wherever you go, the probable risks remain covered.

3. Natural Disaster: Before buying travel insurance, the most important question you must ask the insurer is that does your travel insurance cover natural disasters? If yes, you stay protected against risks arising due to natural calamities during your travel period.

4. Personal belongings and documents: While traveling to international destinations, your personal belongings need to be taken care of. In case it gets lost or damaged during the travel duration, your travel insurance covers risks probable to luggage and document loss.

5. Flight delays: In case of flight delays, there are high possibilities of additional costs, which you may have to incur. Such as stay arrangement, meals, etc. Such expenses can get covered under travel insurance.

These are the 5 most important covers to look for before buying a travel insurance plan. Other than most important coverage there are a few more benefits that need to be looked upon before choosing a travel insurance plan for overseas destination.

Another emergency cover:

Personal Accident (Common Carrier), Hospital Cash, Emergency Dental Treatment, Medical Evacuation, Repatriation, Loss of Checked Baggage, Financial Emergency Assistance, Hijack Distress Allowance, and Contingency Travel Benefit

Breach of Law

Any sickness or health issues caused due to war or a breach of the law.

Consumption of Intoxicant substances

If you consume intoxicant or banned substance, the policy shall not entertain any claims.

Pre-existing diseases

If you’re suffering from a disease before traveling or undergo treatment for an illness which already exists, we do not cover it.

Cosmetic and Obesity Treatment

If you or your family member choose to undergo cosmetic or obesity treatment, it stands uncovered.

Self Inflicted Injury

We apologize but if you hurt yourself or get hospitalized due to a suicide attempt we shall not be able to cover you

Adventure Sports

Any injury caused due to an adventure, the sport remains uncovered.

The above mentioned travel insurance would offer a much wider cover against unforeseen incidents while traveling abroad.

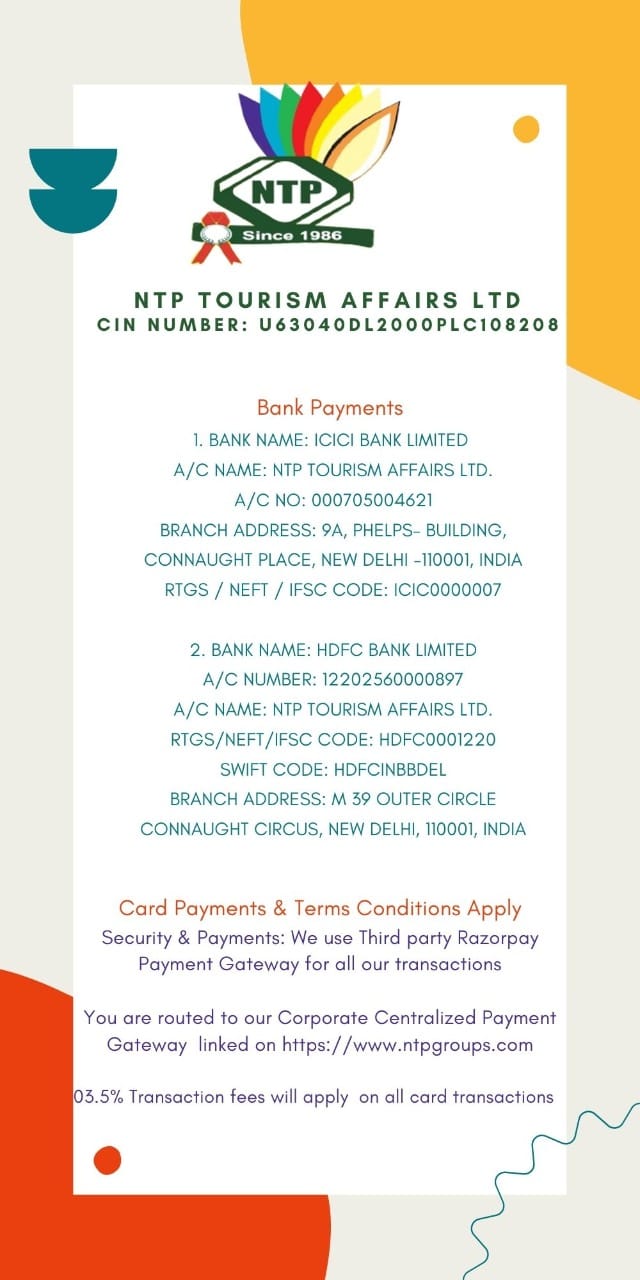

| NTP Healthcare support with the issuance arrangement & claim settlements if any. Please send us an email on info@ntphealthcare.com or what’s app 9810098099 |